About TransitionPG®

TransitionPG

Certified Financial Planner and Financial Consultant

Our mission is to help you achieve your financial, personal, and professional goals.

How We Are Different

- We do not ask you to move your money for us to manage it

- We do not sell investment or insurance products

- We do not receive money from referrals

- We do not require a certain amount of net worth before working with you

We provide a comprehensive approach to your financial plan addressing YOUR key priorities.

Our Approach:

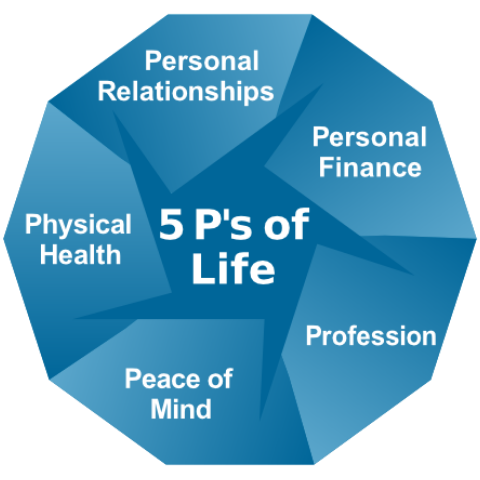

- Personal Relationships (experiences and things you want to provide for your family and friends)

- Personal Finance (how you envision your financial management and how you will save for large purchases)

- Profession (how you generate income)

- Peace of Mind (what you do to strengthen your mental health – stress management, self-worth, volunteering, spirituality, etc.)

- Physical Health (what you do to keep your body strong and healthy)

We provide a comprehensive approach to your financial plan addressing YOUR key priorities.

Leadership

We believe in working collaboratively with other professionals in order to develop sage advice for our clients.

Niv Persaud,

CFP®, CDFA™, RICP®, CRPC®

Managing Director | Founder

Niv Persaud, CFP®, is the Founder of Transition Planning & Guidance™, LLC. She believes life is more than accumulating money – it’s about living the lifestyle you envision and can afford. Over the years, life has become more complicated. What used to be normal expectations have shifted. We’ve redefined many long-held ideas about lifestyle and retirement.

For that reason, Niv looks beyond money when helping clients. She incorporates all aspects of life. She developed the 5 P’s of Life (Personal Relationships, Personal Finance, Profession, Peace of Mind, and Physical Health) to help clients define what they want from life. Once she understands their vision, she can help them save for their lifestyle.

She is frequently quoted sharing her insights on money and life. She has been quoted in Forbes, Reuters, CNBC, Money, and USA Today.

Niv has over 30 years of business experience as a strategy and finance executive. Her work history includes firms such as Korn/Ferry International, Northern Trust, Merrill Lynch, and Commerzbank AG.

She attained her Certified Financial Planner™ professional designation in 2005. She also holds a Chartered Retirement Planning Counselor℠ designation, a Certified Divorce Financial Analyst® designation, and a Retirement Income Certified Professional® designation. All these designations require additional education and exams to attain them, as well as continuing education requirements.

She graduated from the Georgia Institute of Technology with a Bachelor of Industrial Engineering, which established a strong foundation in her analytical and business skills.

Niv actively gives back to the community through her volunteer efforts. She recently co-chaired a multi-day charity event benefiting local children’s charities. She is also a Legacy Advisor at Children’s Healthcare of Atlanta.

Niv has served on the Board of Zoo Atlanta. She is a past-President of the Financial Planning Association of Georgia (a professional organization for CFPs with over 500 members). Additionally, she served on the Georgia Tech Women Alumnae Network Board and the Georgia Tech Women Resource Center Advisory Board. She has also held leadership positions with her church which has over 2,500 members.

Niv lives with her significant other in Sandy Springs, Georgia. She has a stepson from her current relationship and three stepdaughters from her previous marriage. She believes in living life to the fullest by cherishing friendships, enjoying the beauty of nature, and laughing often — even at herself. Her favorite quote is by Erma Bombeck, “When I stand before God at the end of my life, I would hope that I would not have a single bit of talent left and could say ‘I used everything you gave me.’”

MONEY + LIFE TIPS:

Sign-up for our free monthly Money + Life Tips

We respect your privacy and will not sell your information.