About TransitionPG®

TransitionPG

Certified Financial Planner and Financial Consultant

Our mission is to help you achieve your financial, personal, and professional goals.

How We Are Different

- We do not ask you to move your money for us to manage it

- We do not sell investment or insurance products

- We do not receive money from referrals

- We do not require a certain amount of net worth before working with you

We provide a comprehensive approach to your financial plan addressing YOUR key priorities.

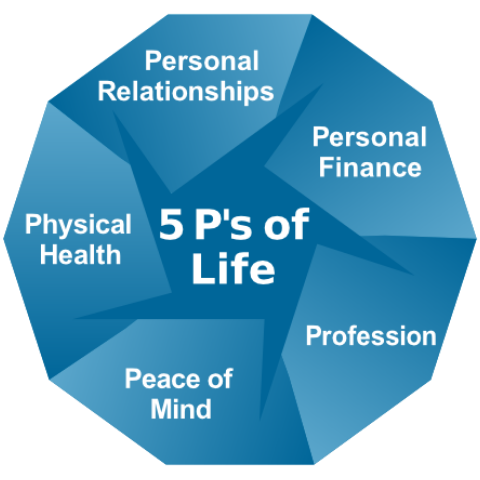

Our Approach:

- Personal Relationships (experiences and things you want to provide for your family and friends)

- Personal Finance (how you envision your financial management and how you will save for large purchases)

- Profession (how you generate income)

- Peace of Mind (what you do to strengthen your mental health – stress management, self-worth, volunteering, spirituality, etc.)

- Physical Health (what you do to keep your body strong and healthy)

We provide a comprehensive approach to your financial plan addressing YOUR key priorities.

Leadership

We believe in working collaboratively with other professionals in order to develop sage advice for our clients.

Niv Persaud,

CFP®, CDFA®, RICP®, CRPC™

Managing Director | Founder

Niv Persaud, CFP®, is the Founder of Transition Planning & Guidance, LLC (TransitionPG®). She believes life is more than accumulating money – it’s about living the lifestyle you envision and can afford.

Over the years, life has become more complicated. What used to be normal expectations have shifted. We’ve redefined many long-held ideas about lifestyle and retirement.

For that reason, Niv incorporates all aspects of life when discussing money. She developed the “5 P’s of Life” (Personal Relationships, Personal Finance, Profession, Peace of Mind, and Physical Health) to help clients define what they want from life.

Once she understands their vision, she can help them achieve their lifestyle or adjust their expectations based on their finances.

She shares her insights on money + life in publications such as Reuters, CNBC, Money, and USA Today (media mentions list).

Niv attained her Certified Financial Planner® professional designation in 2005. She also holds a Chartered Retirement Planning Counselor™ designation, a Certified Divorce Financial Analyst® designation, and a Retirement Income Certified Professional® designation.

All these designations require additional education and exams to attain them, as well as continuing education requirements.

Niv actively gives back to the community through her volunteer efforts. She participates in the mentor program at her alma mater, Georgia Tech. She is also a subject matter expert with the CFP® Board and contributes her time to write exam questions, review potential exam questions, and select scholars.

Currently, Niv serves on the Board at the Atlanta Chapter of ARCS® Foundation, a nationally recognized nonprofit led by women who boost American leadership and aid advancement in science and technology.

In the past, Niv has held Board positions with Zoo Atlanta, Financial Planning Association of Georgia, and Georgia Tech Women Alumnae Network. She has also held leadership positions with her church.

Niv believes in living life to the fullest by cherishing friendships, exploring the world, and laughing often — even at herself.

Her favorite quote is by Erma Bombeck, “When I stand before God at the end of my life, I would hope that I would not have a single bit of talent left and could say ‘I used everything you gave me.’”

MONEY + LIFE TIPS:

Sign-up for our free monthly Money + Life Tips

We respect your privacy and will not sell your information.